30+ 15 year va mortgage calculator

A 15-year fixed-rate mortgage has a 15-year term with a fixed interest rate and payments while a 5-year ARM has a longer 30-year term with a fixed-rate for the first 5 years and then a variable rate for the remaining term. Well explain how you can this below.

Things To Consider For Your Next Web Conference Mortgage Info Lender Articles

A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason.

. But some of 2012 was higher and the entire year averaged out at 365 for a 30-year mortgage. Todays national 15-year refinance rate trends. 5-year ARMs generally offer a lower initial interest rate.

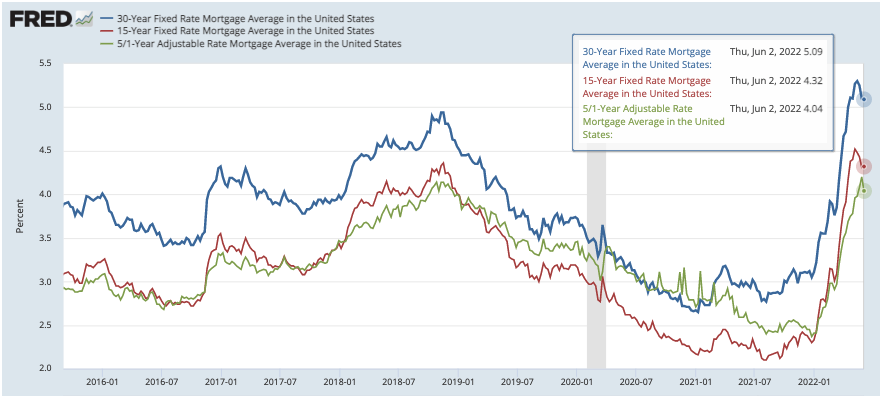

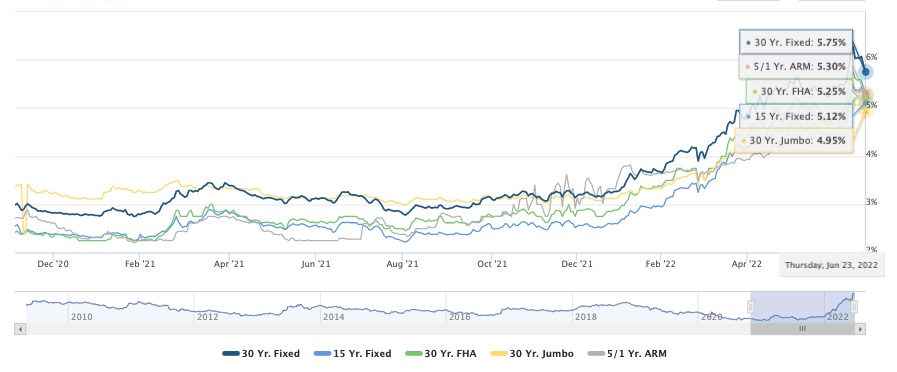

See todays 15-year mortgage rates. It shows historical rate data back to 1971 for the 30-year along with 15-year data back to 1991 and 51 ARM data from 2005 onward. For example a 30-year FRM has 360 monthly payments spread across 30 years.

For today Thursday September 15 2022 the national average 30-year VA mortgage APR is 5650 up compared to last weeks of 5480. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. If a person.

Mortgage interest rates are always changing and there are a lot of factors that. Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Build home equity much faster. Toggle Global Navigation. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Interest rates tend to fluctuate significantly over time. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. How to Apply for a 30-Year.

People typically move homes or refinance about every 5 to 7 years. The national average 30-year VA refinance APR is 5730 up. See todays 30-year mortgage rates.

15 year fixed VA. The following table lists historical mortgage rates for 30-year mortgages 15-year mortgages and 51 ARM loans. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

A 30-year fixed VA loan lets you make lower monthly payments. Youll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year one but because of the. Todays national mortgage rate trends.

Adjustable Rate Mortgage 30-Year Fixed 15-Year Fixed FHA Loan VA Loan USDA Loan Jumbo Loan YOURgage HARP Refinance. 1 Other fees may apply such as discount points to buy down your rate. Members can receive the lender credit upon closing with PenFed subject to qualification and approval.

The best time to get a 30-year mortgage is when interest rates are low. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate.

Includes fixed 15-year mortgage rates for conventional FHA and VA loans plus tips to find your best interest rate. With FHA loans you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage. This makes it a popular financing option for buyers with tight finances.

Compare the latest rates loans payments and fees for 30 Year Fixed VA mortgages. Estimate fixed monthly payments with this free calculator or compare loans. This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage.

This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. 2 For eligible fixed rate ARM and VA loans PenFed offers a lender credit to all members who submit a completed home purchase mortgage application on or after March 1 2020. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.

For today Thursday September 15 2022 the national average 15-year fixed refinance APR is 5560 up compared to last weeks of 5380. If you prefer predictable steady monthly payments a 30-year fixed. Because its a fixed payment schedule if you factor in additional payments you can actually reduce your payment time.

Other government backed loans such as VA and USDA loans have a zero downpayment option. HANNA KIELAR - 4-MINUTE READ - JUNE 23 2022. Bankrates mortgage amortization calculator shows how even a 01.

Check out the advantages of getting a 30-year mortgage with Rocket Mortgage and apply today. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. How does a 15-year fixed-rate mortgage compare to a 5-year ARM.

The rate and payment results you see from this calculator may not reflect your actual. When the loan reaches this level the mortgage automatically converts into a fully amortizing mortgage which requires principal repayment. You can compare costs using a 15-year vs.

For today Thursday September 15 2022 the national average 15-year fixed mortgage APR is 5540 up compared to last weeks of 5360. 30-year mortgage calculator as an example. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan.

The surprise mortgage rate drop-off In 2018 many economists predicted that 2019 mortgage rates. 15 year fixed VA. It allows borrowers to qualify even if they have low credit scores.

Lets compare interest costs between a 30-year fixed mortgage and 15. There are other mortgage products that have shorter terms like 15 and 20 years. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year.

For a 15-year FRM thats 180 monthly payments throughout 15 years. FHA loans come in. Youll have to pay primary mortgage insurance PMI with your 15-year fixed-rate loan if your down payment is less than 20.

For loans 0-199999 the. Todays national 15-year mortgage rate trends.

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Loan Originator Mortgage Infographic

Va Funding Fee Table Home Improvement Loans Refinance Mortgage Home Loans

Va Loan Calculator Check Your Va Home Loan Eligibility

Home Loans St Louis Real Estate News

![]()

Today S Va Mortgage Rates September 2022 Purchase Refi

Va Loan Calculator Check Your Va Home Loan Eligibility

Paramount Residential Mortgage Group Mortgage Rates 6 02 Review Details Origination Data

Va Loan Calculator Check Your Va Home Loan Eligibility

U S Mortgage Delinquency Rate 2000 2022 Statista

Home Loans St Louis Real Estate News

Va Loan Calculator Check Your Va Home Loan Eligibility

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips

Ask Me About Va Loans Casey Nagy Mortgage Loan Originator

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Mortgage Tips

Home Loans St Louis Real Estate News

Today S Va Mortgage Rates September 2022 Purchase Refi

![]()

Today S Va Mortgage Rates September 2022 Purchase Refi