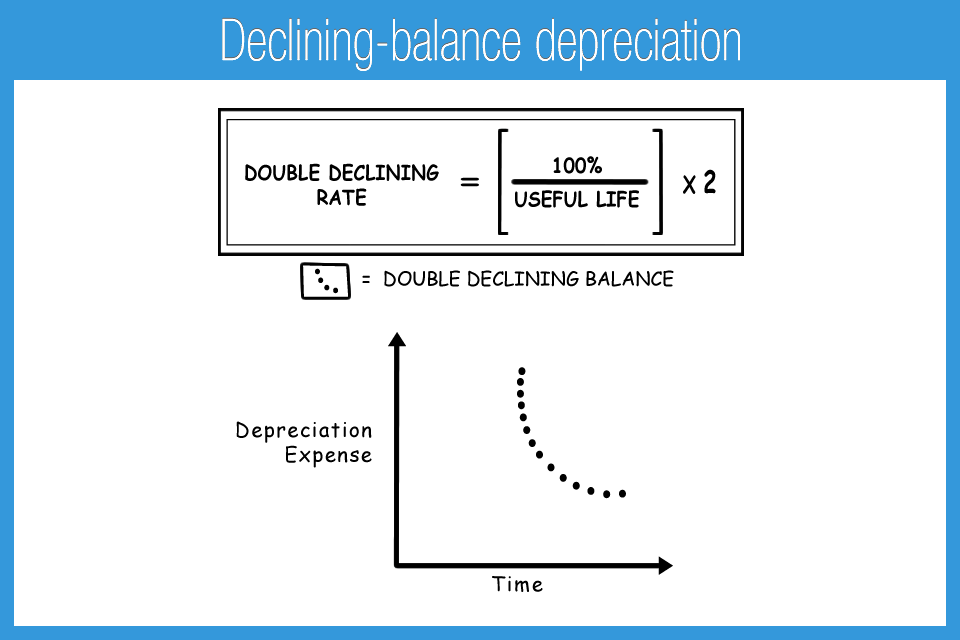

Diminishing balance formula

Thus depreciation is charged on the reduced value of the fixed asset in the beginning of the year under this method. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value.

Double Declining Balance Method Of Depreciation Accounting Corner

Also known as diminishing interest rate or reducing balance interest rate interest accrual under reducing rate calculation varies depending on the outstanding loan amount.

. To calculate reducing balance depreciation you will need to know. Therefore each EMI paid lowers the outstanding principal balance. Double Declining Balance Method.

How to calculate reducing balance depreciation. Must contain at least 4 different symbols. You need to provide the two inputs ie Initial Investment and Cash Inflows.

Economics ˌ ɛ k ə ˈ n ɒ m ɪ k s ˌ iː k ə- is the social science that studies the production distribution and consumption of goods and services. Diminishing Balance Depreciation Method. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is.

Reducing balance depreciation is also known as declining balance depreciation or diminishing balance depreciation. The quantity theory descends from Nicolaus Copernicus followers of the School of Salamanca like Martín de Azpilicueta Jean Bodin Henry Thornton and various others who noted the increase in prices following the import of gold and silver used in the coinage of money from the New WorldThe equation of exchange relating the supply of. Current assets Cash Cash equivalents Inventories Accounts receivable Accounts Receivable Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment.

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Now we would determine this ratio using the simple formula we mentioned above. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Fine-crafting custom academic essays for each individuals success - on time. The first is the two-year cash cash equivalent see the highlighted yellow in the balance sheet above and the second data which is useful to us is the total current liabilities for the years 2014 and 2015. Learn how to calculate marginal revenue the formula to use and see examples.

With the declining balance method one can find the depreciation rate that would allow exactly for full depreciation by the end of the period using the formula. Now the bakery offers him a deal that he would be given 10 on the entire purchase if he purchases one more pastries. The original value of the asset plus any additional costs required to get the asset ready for its.

It is very easy and simple. Management consultant Joseph M. Lets understand the same with the help of examples.

This is a classic example of diminishing marginal utility. Microeconomics is a field which analyzes whats viewed as basic elements in the economy including individual agents and. Economics focuses on the behaviour and interactions of economic agents and how economies work.

We guarantee a perfect price-quality balance to all students. This is because the charging rate is applying to the Net Book Value of Assets and the Net Book. The book value of asset gradually reduces on account of charging depreciation.

Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Inflation is the rate at which the general level of prices for goods and services is rising and consequently the purchasing power of currency is falling. You can easily calculate the Payback Period using Formula in the template provided.

The more pages you order the less you pay. Interest to be paid on each instalment Loan principal amount x total tenure of the loan x interest rate per annumsum total of instalments. The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16.

Reducing balance EMI is also called reducing balance interest rate or diminishing interest rate. This lets us find the most appropriate writer for any type of assignment. The book value of an asset is obtained by deducting depreciation from its cost.

Payback Period Formula in Excel With Excel Template Here we will do the same example of the Payback Period formula in Excel. In 2014 Nestlés ratio was 744832895 023. Where N is the estimated life of.

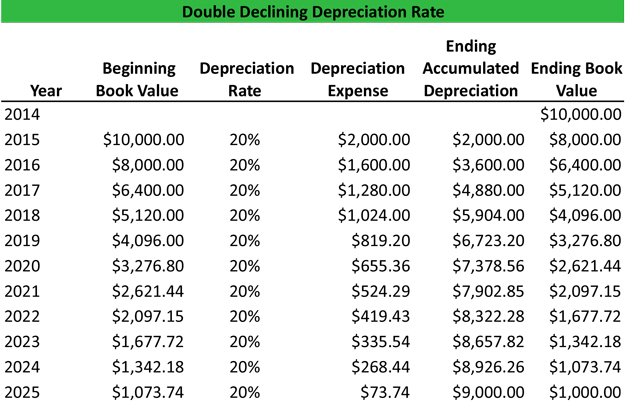

Since the depreciation rate per cent is applied on reducing balance of asset this method is called reducing balance method or diminishing balance method. Declining Balance Method Example. The HeckscherOhlin model HO model is a general equilibrium mathematical model of international trade developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of EconomicsIt builds on David Ricardos theory of comparative advantage by predicting patterns of commerce and production based on the factor endowments of a trading region.

If a business is perfectly competitive then marginal revenue refers to the. The formula for calculating the fixed interest rate EMI is as given below. ASCII characters only characters found on a standard US keyboard.

This revenue calculation follows the law of diminishing returns in that it will slow down as the output level goes up even after a period of consistent output. This kind of depreciation method is said to be highly charged in the first period and then subsequently reduce. 6 to 30 characters long.

Depreciation rate Depreciation expense Accumulated depreciation Book value at year-end 40. Reducing Balance EMI. Marginal Utility Formula Example 2.

The importance of calculating depreciation amount using the diminishing balance method can be best explained using the following situation. It represents the amount of value the. This method is a mix of straight line and diminishing balance method.

Base value days held 365 150 assets effective life Reduction for non-taxable use. They are categorized as current assets on the balance sheet as the payments expected within a year. The Pareto principle states that for many outcomes roughly 80 of consequences come from 20 of causes the vital few.

The calculation of depreciation. Juran developed the concept in the context of quality control and improvement after reading the works of Italian. Let us take the example of David who purchased four pastries for 8 each.

Diminishing balance or Written down value or Reducing balance Method. Existing depreciation rules apply to the balance of the assets cost. Sometimes when a company aims to defer tax liability and reduce profitability in the initial years of asset useful life this method is the best option for charging depreciation.

Other names for this principle are the 8020 rule the law of the vital few or the principle of factor sparsity. We can also offer you a custom pricing if you feel that our pricing doesnt really feel meet your needs. We are an Open Access publisher and international conference Organizer.

Each EMI you pay comprises an interest and principal component. We own and operate 500 peer-reviewed clinical medical life sciences engineering and management journals and hosts 3000 scholarly conferences per year in the fields of clinical medical pharmaceutical life sciences business engineering and technology. Central banks attempt to limit inflation.

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

What Is The Double Declining Balance Ddb Method Of Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Profitable Method Declining Balance Depreciation

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Depreciation Calculator

Declining Balance Depreciation Double Entry Bookkeeping

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Declining Balance Method Of Depreciation Formula Depreciation Guru

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Examples With Excel Template

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Double Declining Balance Depreciation Daily Business

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Method Definition Meaning Example

Depreciation Formula Calculate Depreciation Expense